What is a Dividend?

Before discussing how to calculate dividend yield, lets begin by defining what a dividend is. A dividend is a portion of a company’s profits that it distributes to shareholders. Dividends are paid out in addition to any gains in the value of the company’s shares and reward shareholders for holding a stock.

Additionally, dividends are more common among established companies that can afford not to invest all of their profits back into the business.

What is Dividend Yield?

Dividend yield is the financial ratio that measures the quantum of cash dividends paid out to shareholders relative to the market value per share. The yield is presented as a percentage, not as an actual dollar amount. This makes it easier to see how much return the shareholder can expect to receive per dollar they have invested.

Generally speaking, the higher the dividend yield, the better as it means the potential return from dividends is higher relative to the price you pay for the investment. However, a dividend yield that is too high might be unsustainable. Unexpectedly high yield may be caused by;

- If a company’s stock price has recently plummeted. If a stock has seen a dramatic price decline and its dividend hasn’t been cut yet, the yield can appear high.

- If a company is attempting to woo investors with a high dividend payment. Some companies try to give their stock prices a boost by increasing the dividend to attract new investors. Impressed by the high dividend yield, some investors may buy shares, driving up the stock price

Hence, it is important to check the payout ratio before you make your decision. Also dividend yield cannot be negative since the annual dividends and share price can’t be negative.

Importance of Dividend Yield.

- Dividend yields make it easy to compare stocks. If you’re an income investor, you’ll want to compare and select stocks based on which pay you the highest dividend per dollar you invest.

- Increasing dividend yield indicate financial health. If a company chooses to raise its dividend this tells investors that the company is doing well since it can afford to pay out more of its profits to shareholders.

- Dividends boost return. When you reinvest your dividends, instead of cashing them out every year or quarter, your investment benefits from compounding. Over time, compounding effects can drastically enhance your returns.

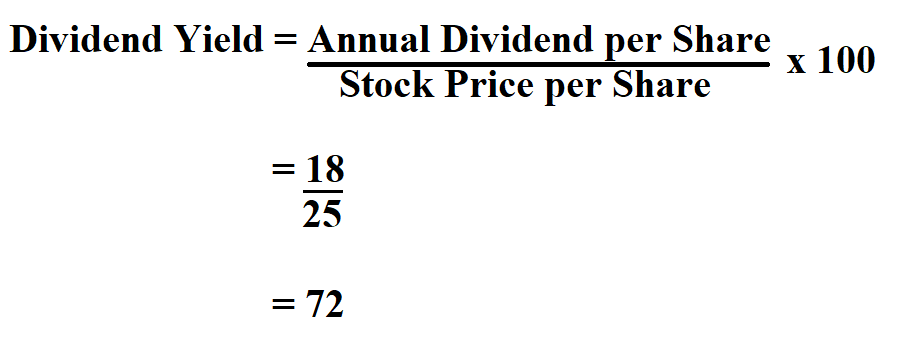

Formula to Calculate Dividend Yield.

Example:

If the annual dividend per share of Company X is $ 30 and the company’s stock price per share is $ 25, calculate the dividend yield.

Thus, the company’s dividend yield is 72%.