In this article, we will define and discuss how to calculate shares outstanding. Shares outstanding are all the shares of a corporation authorized, issued ,purchased by and held by investors.

There are two types of shares outstanding and they are;

- Basic Share.

- Fully Diluted Share.

Basic shares are the number of outstanding stocks currently outstanding, however, fully diluted shares outstanding tells you how many outstanding shares there could potentially be.

The number of shares outstanding increases when a company issues additional shares or when employees exercise stock options. Conversely, they decrease if the company buys back some of its issued shares through a share repurchase program.

In addition to listing outstanding shares, or capital stock, on the company’s balance sheet,publicly traded companies are obligated to report the number of outstanding shares and they tend to package this information within the investor relations sections of their websites, or on local stock exchange websites

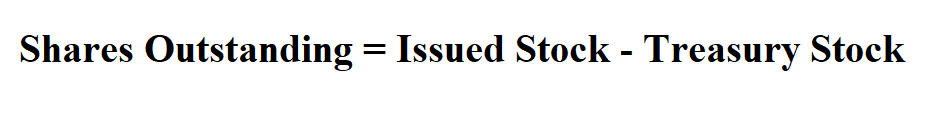

Formula to calculate shares outstanding.

Issued stock is the total number of a company’s sold shares held by shareholders.

Treasury shares are the shares which are bought back by the issuing company, reducing the number of shares outstanding on the open market.

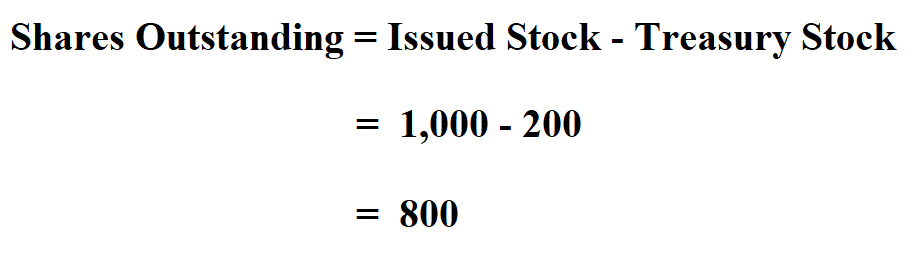

Example:

Suppose a company issues 1000 shares and 200 shares are kept in the company’s treasury, determine the company’s shares outstanding.

Therefore, the company has a total of 800 shares outstanding.