What are Preferred Dividends?

In this article, we are going to define and discuss how exactly to calculate preferred dividends. But before that, lets begin by asking ourselves what is a dividend? A dividend is a distribution of profits by a corporation to its shareholders. Dividends are paid to shareholders as an appreciation of their investment into the business.

With this in mind, we can simply define preferred dividends as the dividends that are accrued paid on a company’s preferred stock.

Any time a company pays dividends, preferred shareholders have priority over common shareholders, which means dividends must always be paid to preferred shareholders before they are paid to common shareholders.

Features of Preferred Stock Dividends.

- Rates are much higher than the rates of equity or common stock. This is because preferred shareholders do not have ownership control over the company; hence, higher dividends rates are offered to them to attract investors.

- Fixed percentage. Unlike the dividend on common or equity stock, which keeps on fluctuating every year depending on the company’s profitability ratios, preferred dividends do not fluctuate.

- Shareholders are entitled to a dividend every year irrespective of the profitability of the Company.

Advantages of Preferred Dividends.

- The preferred dividend rate is fixed this provides more stability for shareholders than common shares do. However, a firm can skip the equal payment of preferred dividends to preferred shareholders and choose to pay the dividends in arrears.

- Preferred dividends typically pay a higher rate than dividends paid to common shareholders, which is one of the main benefits of these dividends.

- There is a lot more transparency with preferred dividends than with common stock this is because the preferred stock rates and terms are also displayed on the balance sheets of the company.

- Even in case of bankruptcy, the preferred dividends are eligible to be paid from the assets of the company first. It’s a legal obligation for the company to pay-out the preferred dividend.

Disadvantages of Preferred Dividends.

- If a company’s earnings go up, the company may increase the dividend rate it pays to common stock shareholders. However, for most preferred shareholders, who own non-participating stock, the dividend rate will always remain the same.

- Fixed rates can also be disadvantageous as when inflation is high they are not adjusted for inflation. Over time, when there is inflation, the fixed dividend will lose purchasing power.

- Companies are obligated to make up past due preferred dividend payments. However, that is not always possible. If the company goes bankrupt, and it still has past dividend payments due, it may not have the money to make those missed payments

Formula to Calculate Preferred Dividends.

Par value, in finance and accounting, means stated value or face value.

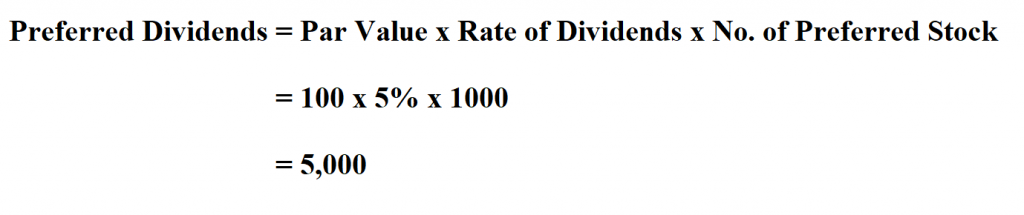

Example:

Suppose you have invested in preferred stock of a firm. As the prospectus says, you will get a preferred dividend of 5% of the par value of shares. If the par value of each share is $100 and you bought 1000 preferred stocks. Calculate your preferred dividends.

Therefore, your preferred dividends are $ 5,000.