In this article, we will define and discuss how to calculate book value per share. It is defined as the minimum amount of the assets that will go to common equity in the event of liquidation. Simply, it’s a measure of what shareholders would theoretically get if they sold all of the assets of the company and paid off all of its liabilities.

This book value per share concept is useful in identifying undervalued stocks. If a stock is trading below its book value per share, it means that the market is valuing the company at less than its liquidation value.

Method to Increase Book Value Per Share.

- Increase your company’s total equity by repurchasing shares or by issuing new stock shares.

- Decrease the company’s liabilities by debt reduction and by selling off assets.

- Increase the value of the asset balance sheet by investing in new equipment or property, or by increasing the efficiency of the company’s operations.

Limitations of BVPS.

- BVPS does not take into account intangible assets such as patents and trademarks.

- BVPS is not forward looking as it focuses on historical costs rather than current market values.

- This value it doesn’t tell you much as an investor. Investors must compare the BVPS to the market price of the stock to begin to analyze how it impacts them.

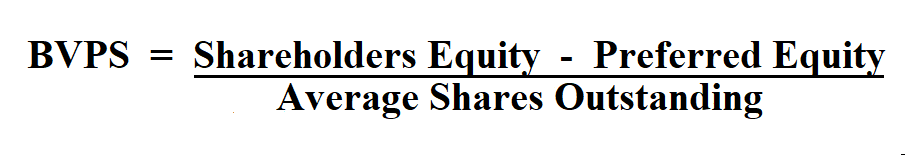

Formula to Calculate Book Value per Share.

Shareholders’ equity, is the remaining amount of assets after all liabilities have been paid.

Preferred equity is a measure of equity which only takes into account the preferred stockholders, and disregards the common stockholders.

Total Common Shares Outstanding represents the number of primary common shares equivalent outstanding.

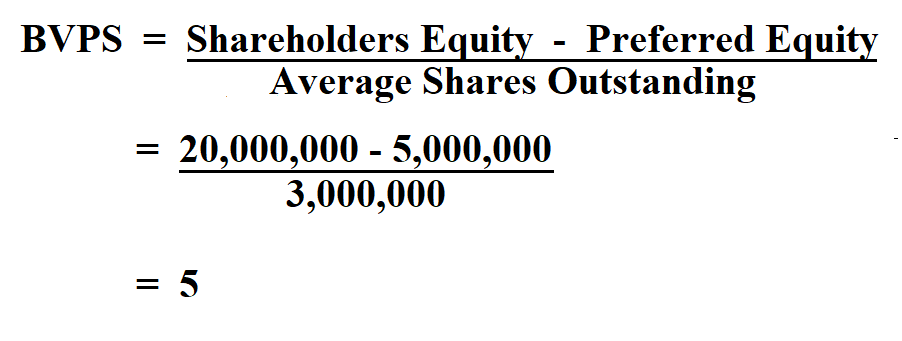

Example:

XYZ stock has $20 million of stockholders’ equity, $5 million of preferred stock, and an average of 3 million shares outstanding during the measurement period.

Therefore, the BVPS is $ 5.