What are Liabilities?

Ahead of discussing how to calculate total liabilities, lets begin by defining liabilities. Total liabilities are the aggregate debt and financial obligations owed by a business to individuals and organizations at any specific period of time.These include day-to-day obligations to business partners and employees as well as debt taken on to finance the organization and they are reported on a company’s balance sheet.

They are two main types of liabilities:

- Current liabilities and

- Non-current liabilities.

Current Liabilities.

Current liabilities also known as short-term liabilities, are liabilities that are due within one year or less. Because payment is due within a year, investors and analysts are keen to ascertain that a company has enough cash on its books to cover its short-term liabilities.Examples of current liabilities are:

- Wages and salaries

- Sales taxes

- Accounts payable

- Short-term notes payable

- Accrued expenses

- Dividends payable etc.

Non Current Liabilities.

Long-term liabilities, or non current liabilities, are debts and other non-debt financial obligations with a maturity beyond one year. Less liquidity is required to pay for long-term liabilities as these obligations are due over a longer time frame. Examples of long-term liabilities might include:

- Notes payable

- Mortgage payable

- Capital lease

- Deferred tax liabilities

- Provisions

Other Liability Types.

Other liabilities are any unusual debt obligations a company may have. These are typically minor, like sales taxes or inter company borrowings. Still, accountants and investors may investigate these to ensure that a company is financially healthy.

Formula to Calculate Total Liabilities.

Total assets refers to the total amount of assets owned by a person or entity that has an economic value.

Shareholders’ equity is the remaining amount of assets after all liabilities have been paid.

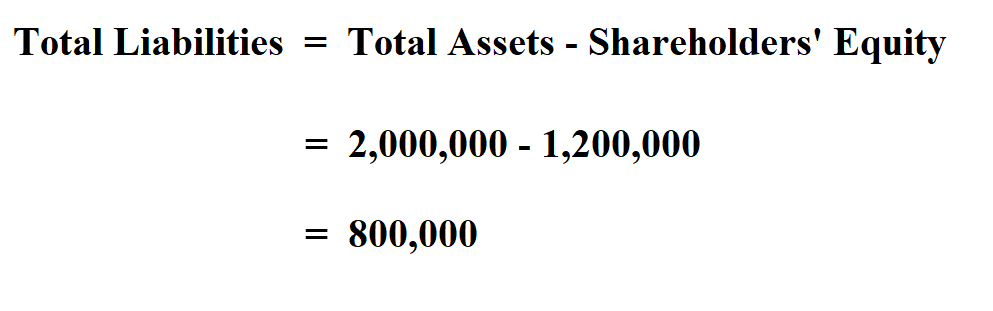

Example:

Calculate the total liabilities of a company whose total assets’ value is $ 2 Million and its shareholders’ equity value is $ 1.2 Million.

Therefore, the total liability of the company is $ 800,000.