EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a measure of a company’s overall financial performance.

EBITDA minimizes the non-operating effects that are unique to each company. It then allows investors to focus on operating profitability as a singular measure of performance.

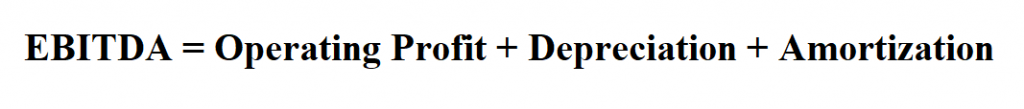

Formula to calculate EBITDA.

Depreciation is the reduction in the value of an asset that occurs over time as the asset gets older or as wear and tear occurs, or the decline of one currency in relation to others.

Amortization is an accounting technique used to periodically lower the book value of a loan or intangible asset over a set period of time.

Operating profit is the profitability of the business, before taking into account interest and taxes.

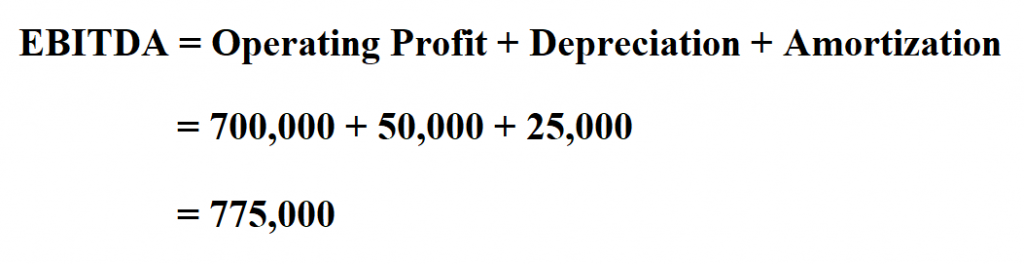

Example:

Suppose the depreciation cost is $ 50,000 and the amortization cost is $ 25,000 while operating profit is $ 700,000. Calculate the EBITDA.

Therefore, the EBITDA is $ 775,000.