Prior to discussing how to calculate interest expense, let us define it. Interest expense is a non-operating expense shown on the income statement. It represents interest payable on any borrowings, loans or lines of credit.

A company’s interest expense is included on its income statement and represents the interest accrued but not necessarily paid during a certain time period. Companies account for interest as it is charged, not when cash for interest payments actually leaves their coffers.

Interest expense does not include other fixed payment obligations of a company such as paying dividends on preferred stock. Also not included in interest expense is any payment made toward the principal balance on a debt.

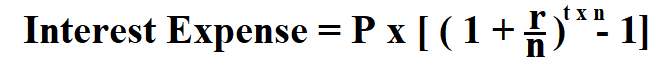

Formula to Calculate Interest Expense by;

Simple Interest Method.

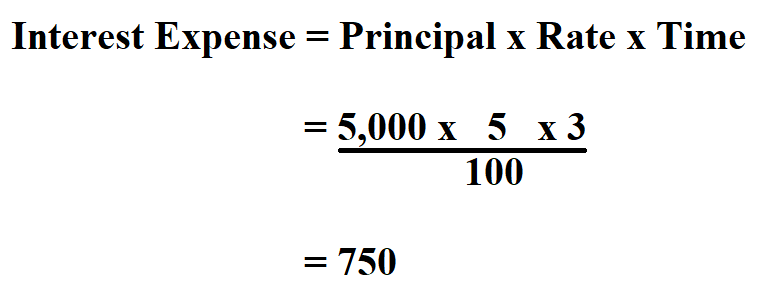

Example:

An individual took a loan of $ 5,000 from a bank. The interest rate was 5% and he was to payback in 3 years. Determine his interest expense.

Therefore, the interest expense is $750.

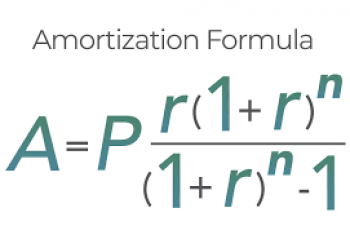

Compounding Interest Method.

- P = Principal.

- t = No. of years.

- n = No. of compounding per year.

- r = Annualized rate of interest.

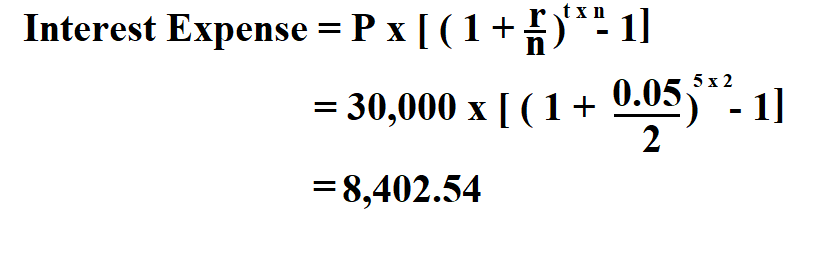

Example:

A man took a loan of $ 30,000 to be paid back at a 5% interest per annum compounded semi-annually, to be paid back after 5 years. Determine the interest expense.

Therefore, the interest expense is $ 8,402.54.