A firm’s cost of equity represents the compensation the market demands in exchange for owning the asset and bearing the risk of ownership.

A firm uses cost of equity to assess the relative attractiveness of investments, including both internal projects and external acquisition opportunities.

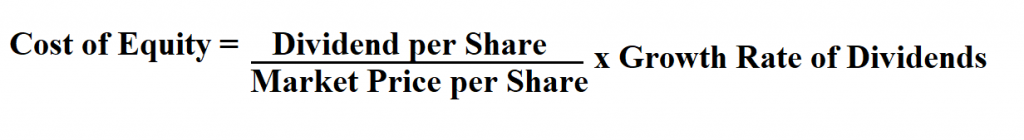

Formula to calculate cost of equity.

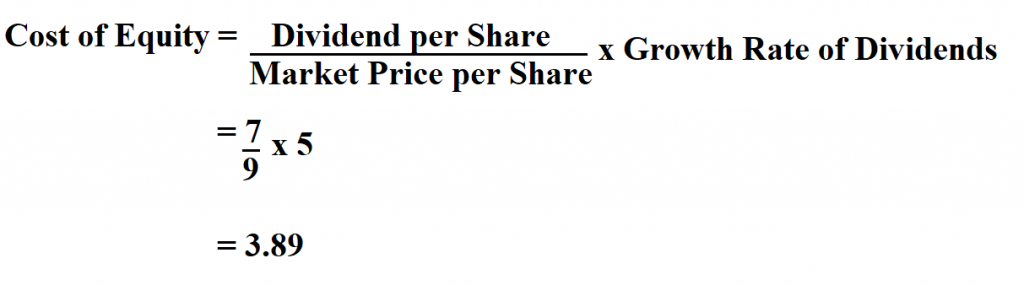

Example:

Company A had its dividends per share at $ 7, its market price per share was $ 9 and the growth rate of its dividends in that year was 2%. Determine its measure of cost of equity.

Thus, the cost of equity is 3.89%.