Taxes are used to pay the salaries of government workers, support common resources, such as police and firefighters. Tax money helps to ensure the roads you travel on are safe and well-maintained and they are also used to fund public libraries and parks.

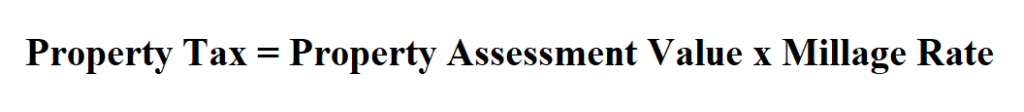

Property taxes are charges that the government levies that correspond to what you own, instead of what you earn or spend.

Formula to calculate property tax.

One mill is equal to one dollar per $1,000 of assessed value.

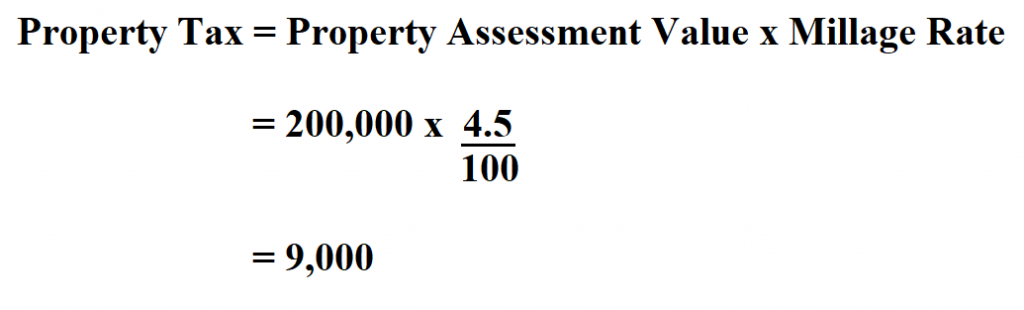

Example:

Assume that your property assessment value is $200,000 and the our local mill rate is 4.5%. Determine your property tax.

Thus, your property tax is $ 9,000.