In this article, we are going to discuss how to calculate cost of debt but before then, lets define it. A company’s cost of debt is the effective interest rate a company pays on its debt obligations, including bonds, mortgages, and any other forms debt.

There are two common ways of estimating the cost of debt. The first approach is to look at the current yield to maturity or YTM of a company’s debt. If a company is public, it can have observable debt in the market.

The other approach is to look at the credit rating of the firm found from credit rating agencies. This approach is particularly useful for private companies that don’t have a directly observable cost of debt in the market.

The cost of debt measure can also give investors an idea of the company’s risk level compared to others because riskier companies generally have a higher cost of debt.

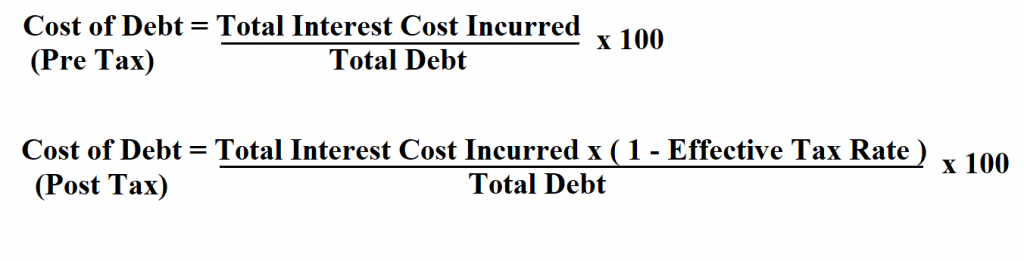

Formula to Calculate Cost of Debt.

Effective tax rate is the average rate at which firm is taxed on its profits.

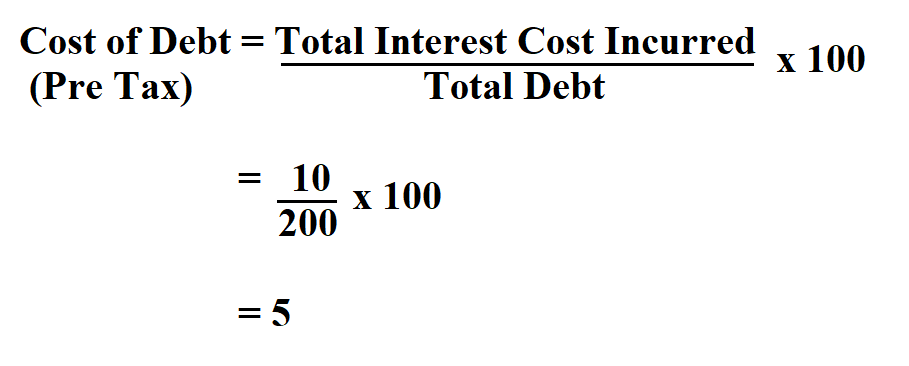

Example 1:

If the total interest cost incurred on $ 200 loan is $ 10. Determine the cost of debt before tax.

Thus, the measure of the cost of debt before tax is 5%.

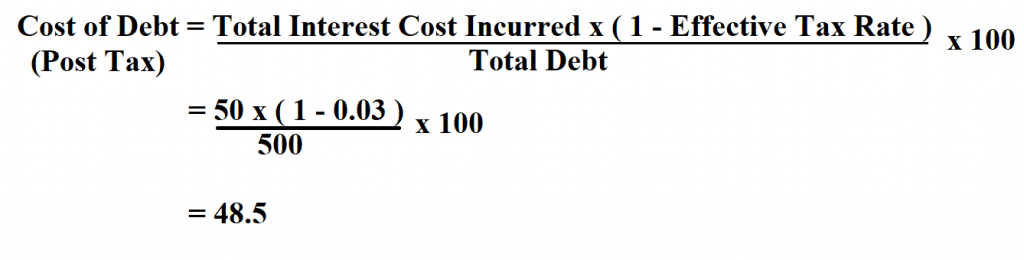

Example 2:

Assuming a 20% effective tax return, calculate the cost of debt after tax if the total interest cost incurred on a $500 loan is $50.

Therefore, the cost of debt after tax is 48.5%.