What is Gross Profit?

Prior to discussing how to calculate gross profit ratio, let us define gross profit. Gross profit is the profit a company makes after deducting the costs associated with making and selling its products, or the costs associated with providing its services.

Gross profit ratio is a profitability measure calculated as the gross profit ratio to net sales. It shows how much profit the company generates after deducting its cost of revenues.

Importance of Gross Profit Ratio.

- GP ratio gives the management a clear picture of how much capital they can reinvest.

- Gross profit tells how a company is doing better or worse than its competitors because the higher the efficiency, the higher the gross profit.

- It can attract or discourage the investors. A high gross profit ratio will make a company very attractive for potential investors while a low ratio typically means that, although the company may be generating high revenue numbers, it will require major restructuring to lower its spending.

Limitations of GP Ratio.

- It does not consider the company’s expenses usually charged to the profit and loss account.

- It is only a passive indicator of the company’s overall status.

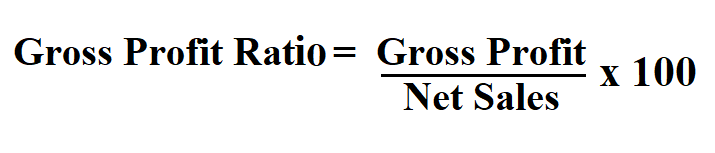

Formula to Calculate Gross Profit Ratio.

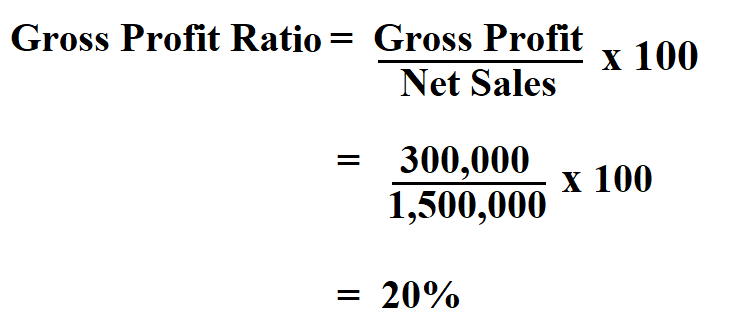

Example:

A company made a gross profit amounting to $ 300,000. The value of the net sales for that financial period was $ 1,500,000. Determine the gross profit rate for that year.

Therefore, the gross profit ratio is 20%. This means that 20% of every sales dollar represents profit before selling and administrative expenses.