What is a Bad Debt Expense?

Before we learn how to calculate bad debt expense, you should know that every business assumes the risk of non-payment when offering sales on credit. Bad debt expense (BDE) helps you record the impact uncollectible accounts have on your bottom line.

Simply put a bad debt is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be noncollectable.

A bad debt expense is recognized when a receivable is no longer collectible because a customer is unable to fulfill their obligation to pay an outstanding debt due to bankruptcy or other financial problems.

Why do Bad Debt Happen?

- Disagreements. This happens when the consumer is dissatisfied with your product or service quality and refuse to pay.

- Bankruptcy. This is when the customers liquidates their assets and is still not able to make payments.

- Poor communication. This can happen if the sales teams offer credit terms without the accounts receivable department’s input, therefore creating misunderstandings around payment terms.

Reporting Bad Debts.

Bad debt can be reported on the financial statements using the following two methods.

- Direct write-off. When it becomes apparent that a specific customer will not pay what they owe, the amount of the invoice is charged directly to bad debt expense. It is a debit to the bad debt expense account and a credit to the accounts receivable account. Thus, the expense is directly linked to a specific invoice. This is not a reduction of sales, but rather an increase in expense.

- Allowance Method. Under this method, the bad debts are anticipated even before they occur. An allowance for doubtful accounts is established based on an estimated figure. This is the amount of money that the business anticipated losing every year.

Like all accounting principles, bad debt expense allows companies to accurately and completely report their financial position.

A significant amount of bad debt expenses can change the way potential investors and company executives view the health of a company.

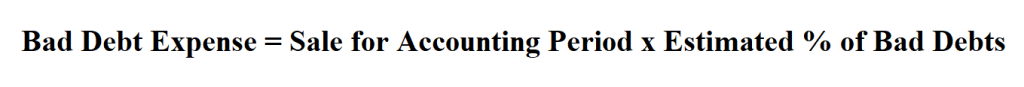

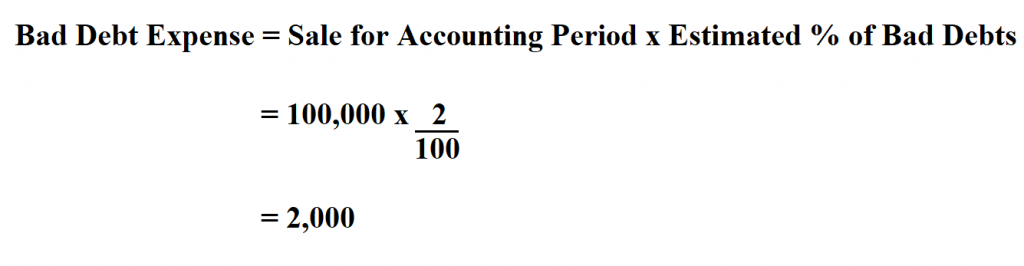

Formula to Calculate Bad Debt Expense.

Example:

Suppose a company sold goods worth $100,000 0n credit. Assuming that 2% of sales are not collectible. Determine the bad debt expense.

Therefore, the company’s bad debt expense is $ 2,000.