What is NOPAT?

Ahead of talking about how to calculate NOPAT, first, let us define what it is and what it entails. NOPAT is short for Net Operating Profit after Tax. Net operating profit after tax is a financial measure that shows how well a company performed through its core operations, net of taxes.

In addition, NOPAT represents a company’s theoretical income from operations if it had no debt, no interest expense, and no non-operating income taxes. NOPAT is used when comparing businesses as it eliminates the impact of their capital structure, which can make it easier to compare two businesses in the same industry.

Who Uses Net Operating Profit After Tax.

Money lenders – Understanding a company’s overall profitability is important to moneylenders. Analyzing NOPAT helps them determine a company’s ability to pay back loans.

Executives – When executives understand their company’s profitability, it helps them make important business decisions. It also helps executives find potential investors to help produce more capital.

Investors and Shareholders – NOPAT help investors and shareholders understand the profitability of their investments. They then use it to determine whether to continue their investment or to invest further.

Advantages of NOPAT.

NOPAT gives a crystal-clear view of the cash flow of a business because it is calculated based on real values derived from your financial transactions such as net income, non-operating gains, non-operating losses, and tax rate.

Also NOPAT can better showcase the performance and operations of a business when compared to calculating the net income of a business after the addition of tax.

It is frequently used in economic value added calculations and is a more accurate look at operating efficiency for leveraged companies.

Disadvantages of NOPAT.

NOPAT compares businesses that are from the same industry but it does not take into account the different growth stages that those businesses may be at. The varying growth stages can have an impact on the business and its operations.

Also in some businesses, the treasury staff might have done something that has impacted the capital structure of a business. As NOPAT doesn’t consider this aspect, it doesn’t fully uncover the potential of a business.

Formula to Calculate NOPAT.

There are two formulas that we can use to calculate NOPAT. The first formula is a simpler version and provides a NOPAT estimate while the second formula is more complex and is more accurate in comparison.

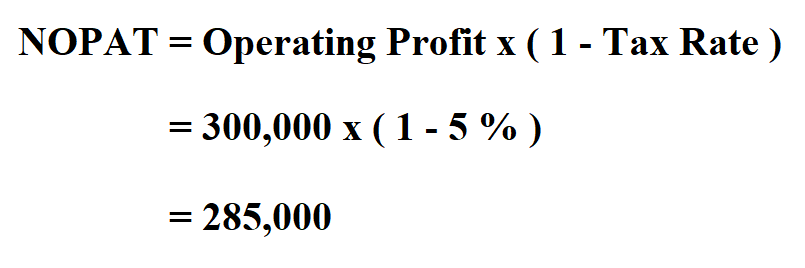

Formula 1.

Operating profit is the profitability of the business, before taking into account interest and taxes.

Example 1:

Suppose the tax rate is 5% and the operating profit is $ 300,000. Calculate the net operating profit after tax.

Therefore, the NOPAT is $ 285,000.

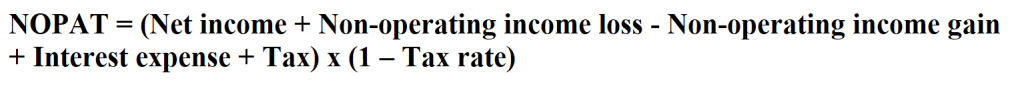

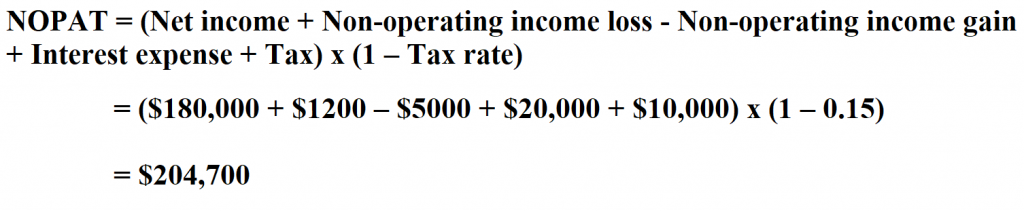

Formula 2.

Example 2:

Calculate the Net Operating Profit After Tax if given the following data.

Net income $180,000

Non-operating income loss $1200

Non-operating income gain $5000

Interest expense $ 20,000

Tax expense $10,000

Tax rate 15%

Hence, the NOPAT is $204,700.