In this article we will learn how to calculate MIRR but before that, lets define it. MIRR is short for modified internal rate of return and it is a financial measure of an investment’s attractiveness.

It accounts for positive cash flows reinvested in a business or a project and solves some of the problems associated with IRR regarding the positive cash flow.

There are three approaches we can use to calculate MIRR and they are;

- The discounting Approach. All negative cash flows are discounted to the current investment and added to the initial cost.

- Reinvestment Approach. Here all positive and negative cash flows except the first one are compounded to the end of the project tenure.

- The Combination Approach. This is a hybrid method where the two methods above merge.

MIRR is an incredible concept as it helps investors to choose between unequal investments and also allows them to alter the assumed rate of reinvestment growth at every stage in an investment project.

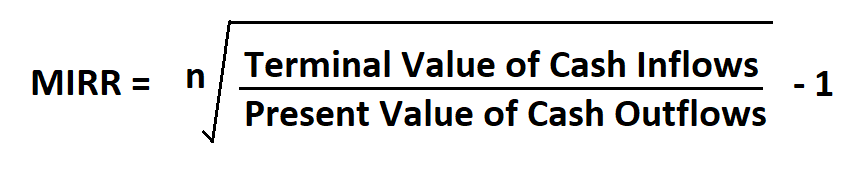

Formula to Calculate MIRR.

n is the number of years the project will last.

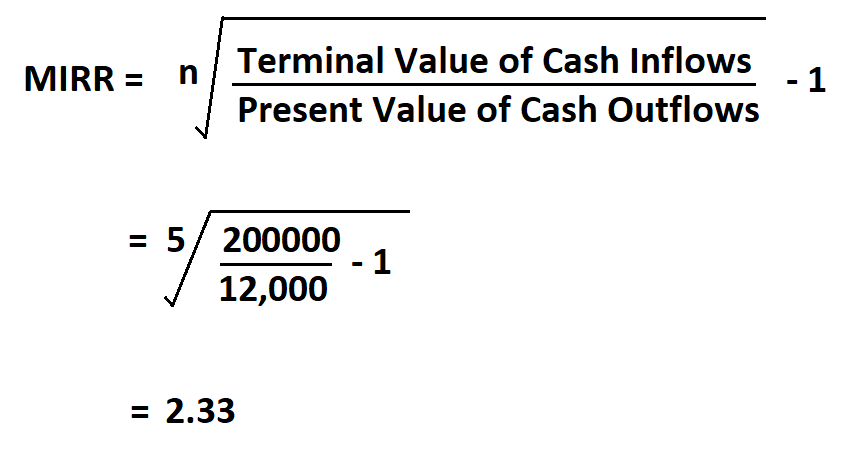

Example:

Suppose you invested in a project whose lifetime is 5 years, if you expect the terminal cash inflow to be $ 200,000 and the present value of the cash outflow is 12,000, calculate MIRR.

Therefore, your MIRR is 2.33%.