Before we get into discussing how to calculate goodwill, let us define it. In accounting, goodwill is an intangible asset that arises when a buyer acquires an existing business. The gap between the purchase price and the book value of a business is known as goodwill. Accounting for goodwill is important to keep the parent company’s books balanced.

The goodwill of a company increases its value, as qualities such as the company’s customer base, its brands, products, location, workforce, and reputation demonstrate the company’s proven track record of generating income.

Relevance of Goodwill.

Understanding this concept is very important as it is the metric that encapsulates the value of a company’s reputation built over a significant period.

Goodwill is considered as an intangible asset with an indefinite life, and as such, there is no requirement to amortize the value.

When a company is acquired for less than its tangible net worth, it is said to have a negative goodwill. The appropriate pricing for goodwill is extremely difficult, but it does make a commercial enterprise more valuable.

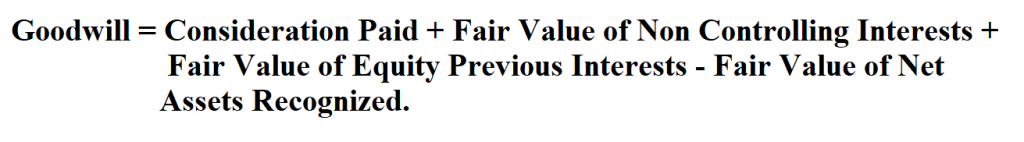

Formula to Calculate Goodwill.

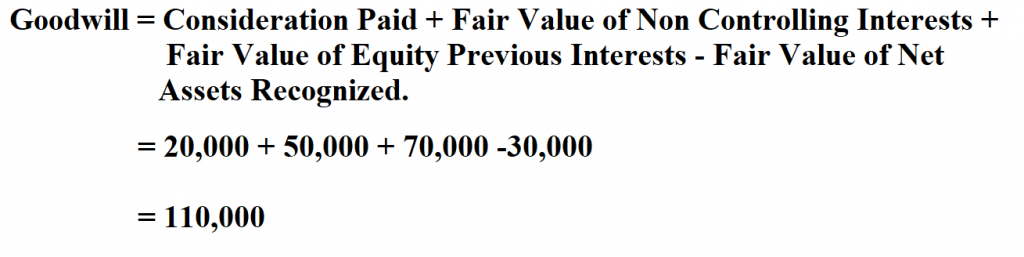

Example:

Suppose a company’s financial statement was as follows:

| Consideration Paid | $20,000 |

| Fair value of non-controlling interests | $50,000 |

| Fair value of equity previous interests | $70,000 |

| Fair value of net assets recognized | $30,000 |

Calculate the company’s goodwill cost.

Therefore, the company’s goodwill is $110,000.