Taxable income is the amount of income used to calculate how much tax an individual or a company owes to the government in a given tax year.

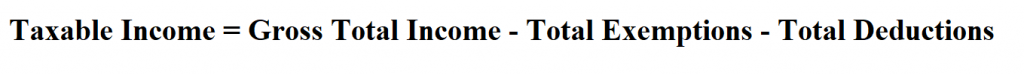

Formula to calculate taxable income.

Different types of tax exemptions may include charities, humanitarian aids, educational materials, etc.

Different types of tax deduction may include interest on a student loan, interest on the home loan, medical expense, etc.

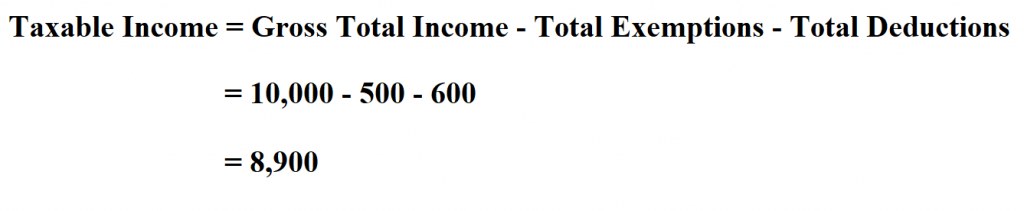

Example:

An employee in a company earns a gross total income of $ 10,000 per month, the value of his total tax exemptions per month is $500 and his total tax deductions is $600. Determine his taxable income.

Therefore, the taxable income is $ 8,900.