What is Predetermined Overhead Rate?

Ahead of discussing how to calculate predetermined overhead rate, let’s define it. A predetermined overhead rate(POHR) is the rate used to determine how much of the total manufacturing overhead cost will be attributed to each unit of product manufactured.

We can also define the POHR as the distribution of expected manufacturing cost to the presumed units of machine hours, direct labor hours, direct material hours etc., for acquiring the per unit expense before every accounting period.

The predetermined overhead rate, also known as the plant-wide overhead rate, is used to estimate future manufacturing costs. This estimate is made at the beginning of the accounting period.

Since POHR is purely based on estimates, this means that there might be a difference between the actual and the estimated amounts of overhead and therefore, they must be reconciled at least at the end of each financial year.

Larger organizations tend to employ a different POHR in each department which improves the accuracy of overhead application even though it increases the amount of required accounting labor.

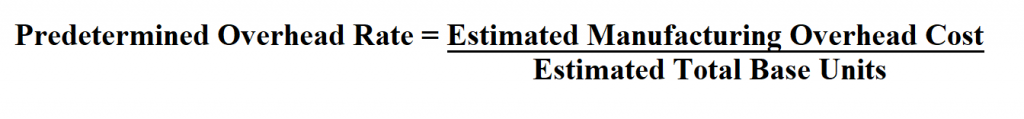

Formula to Calculate POHR.

- Work out the different overhead costs and the total amount.

- Figure out which costs are the same and have a relationship with different allocation base.

- Determine the allocation base for the department in question. An allocation base or the activity base is the is the basis on which Cost accounting allocates overhead costs. The common allocation bases are direct labor costs, direct labor hours, machine hours and direct materials.

- Then divide the overhead cost by the allocation base to get your predetermined overhead rate.

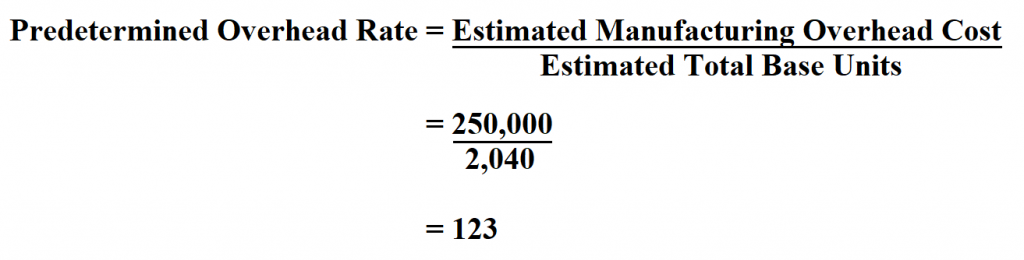

Example 1:

Suppose the estimated manufacturing overhead cost is $ 250,000 and the estimated labor hours is 2040. Calculate the predetermined overhead rate.

In this example, the allocation base is the labor hours.

Therefore, the predetermined overhead rate is 123 per direct labor hour.

Example 2:

Company A allocates overhead based on machine hours. Use the data below to determine the company’s predetermined overhead rate.

Estimated manufacturing overhead cost $180,000

Actual manufacturing overhead cost $200,000

Estimated machine hours $10,000

Actual machine hours $18,000

Since,

Predetermined Overhead rate = Estimated Annual Overhead Cost ÷ Expected Annual Operating Activity.

Therefore,

= 180,000 ÷ 10,000

= $18 per machine hour.