Average tax rate or effective tax rate is the share of income that he or she pays in taxes.

The average tax rate helps the government figure out how much tax was paid overall.

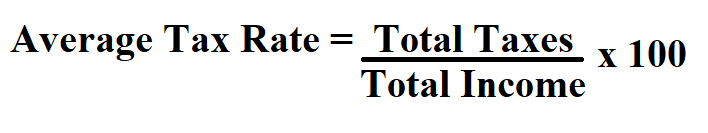

Formula to calculate average tax rate.

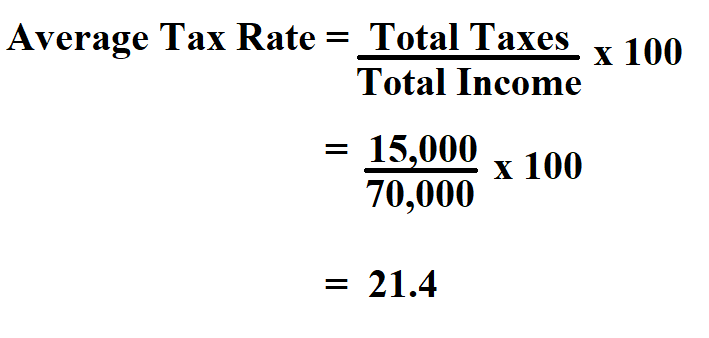

Example:

Chris earned $70,000 in 2019. He estimates his total tax liability at $15,000. Determine his average tax rate.

Therefore, his average tax rate is 21.4%.