Social security wages are those earnings that are subject to the Social Security portion of the Federal Insurance Contribution Act (FICA) tax.

These wages are used by the Social Security Administration to determine social security benefit calculations at retirement.

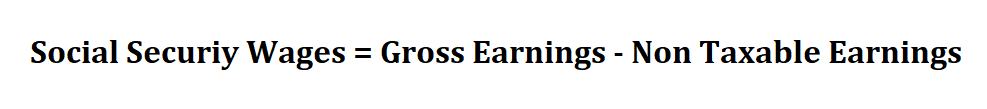

Formula to calculate Social Security Wages.

The non taxable earnings in this case are the earnings that are not subject to FICA tax.

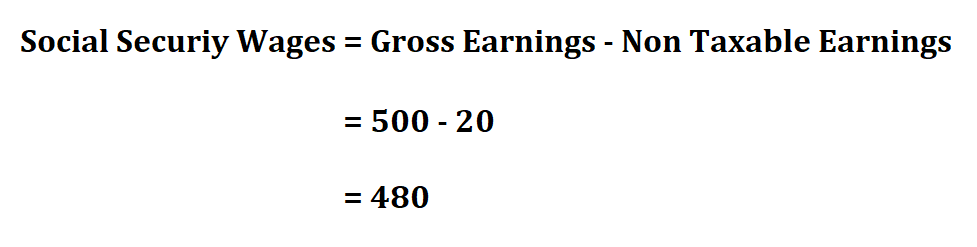

Example:

Calculate the social security wages if your gross earnings are $ 500 per month and your non taxable earnings amount to $ 20.

Therefore, the amount of your earnings that is taxable is $ 480.