Sharpe ratio is a measure of the excess return per unit of risk in an investment asset or a trading strategy.

This concept is used to characterize how well the return of an asset compensates the investor for the risk taken.

It also helps to explain whether portfolio excess returns are due to a good investment decision or a result of too much risk.

A negative Sharpe ratio indicates that a risk-less asset would perform better than the security being analyzed.

Sharpe Ratio Grading Thresholds:

- Less than 1: Bad

- 1 – 1.99: Adequate/good

- 2 – 2.99: Very good

- Greater than 3: Excellent

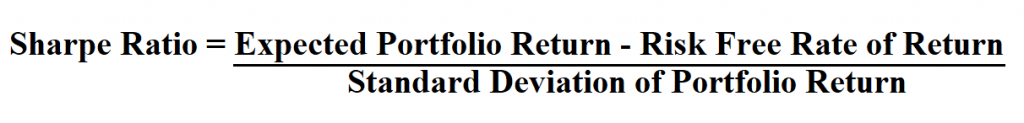

Formula to calculate Sharpe ratio.

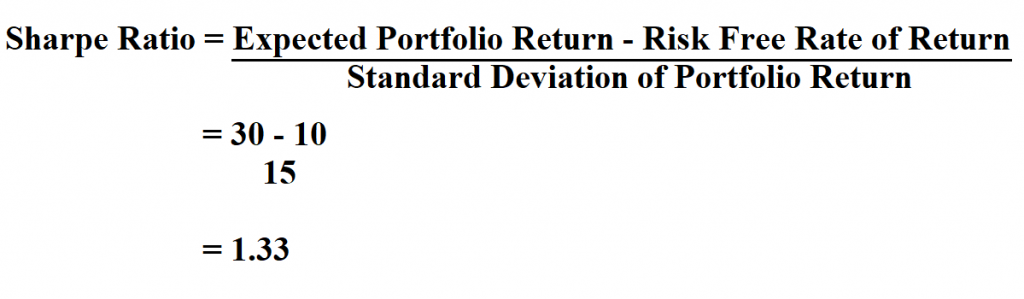

Example:

Suppose you are asked to find the Sharpe ratio of a Fund which has a 30% portfolio return a 10% free risk return and a 15 standard deviation of portfolio return.

Therefore, the Sharpe ratio of the fund is 1.33.