In this article, we will learn how to calculate double declining balance also known as accelerated depreciation but before that, lets define it. We define DDB as a method of depreciation of fixed assets where the depreciation expense is greater in the initial years of the asset’s assumed useful life.

We can best apply this approach to assets that quickly lose value in the first few years of ownership like cars and other vehicles but may also apply to business assets like computers,

Benefits of Double Declining Balance.

Writing off larger depreciation can result in larger tax benefits at the beginning of the recovery period. This can be helpful with repaying the cost of an asset, particularly if you’ve used credit or a loan to purchase it and can pay off a larger principal amount and reduce overall interest payments.

We can also use this concept when the business intends to recognize the expense in the early stage to reduce profitability and thereby defer taxes.

Disadvantages of DDB.

- It is a bit more complex than the more traditional and simpler straight-line method.

- Most assets are consistently in use over their useful life; thus, depreciating them at an accelerated rate does not make sense. Further, it does not reflect the actual use of the asset.

- This approach results in the skewing of profitability results into future periods, which makes it more difficult to ascertain the true operational profitability of asset-intensive businesses.

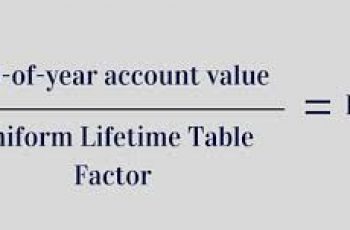

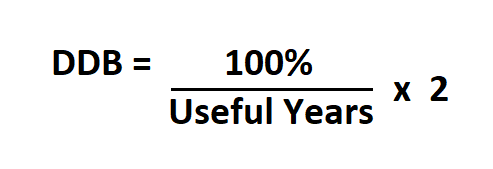

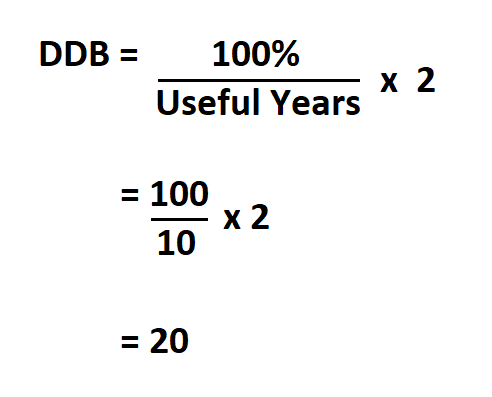

Formula to Calculate Double Declining Balance.

Example:

Suppose a project’s has 10 useful years, calculate the DDB.

Therefore, your double declining balance is 20%.