We can define Capital Gains Tax (CGT) as the tax that levied on transfer of property or simply as the cut the government gets when you realize a profit on your investments.

Capital gains tax reductions are often proposed as a policy that will increase saving and investment and boost long-term economic growth.

The U.S. capital gains tax only applies to profits from the sale of assets held for more than a year. Short-term sale of assets is taxed normally.

The capital tax rates vary from an entity to another depending on their tax bracket. The tax rates are 0%, 15%, and 20.

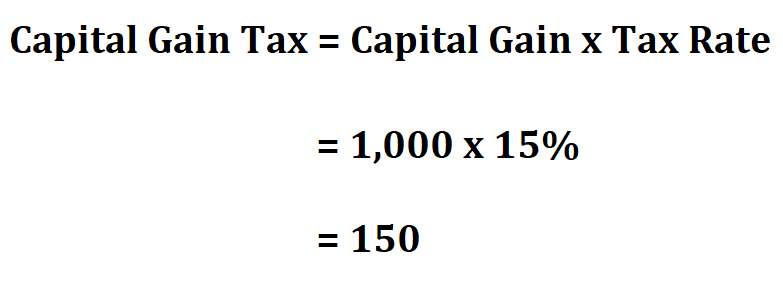

Formula to calculate capital gain tax.

Example:

Suppose you sold your home after having it for 3 years and realized a profit of $ 1000, calculate your capital tax gains if your tax bracket is 15%.

Therefore, the capital gain tax is $150.