A tax refund is a reimbursement to a taxpayer of any excess amount paid to the federal government or a state

On tax returns, taxpayers calculate their tax liability, schedule tax payments, or request refunds for the over-payment of taxes.

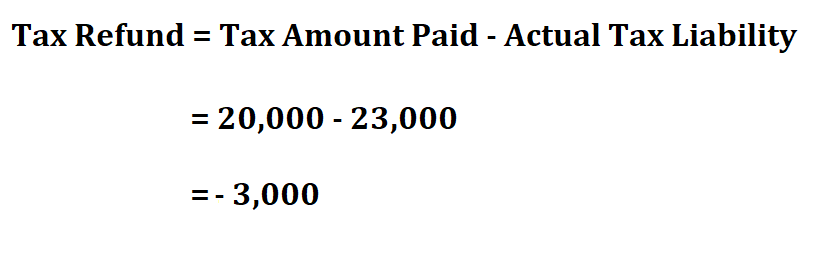

Formula to calculate tax refund.

To calculate your tax return, you first need to know your tax liability. Then find the difference of the amount you paid for tax and your actual tax liability.

Example:

If for instance your company paid $ 20,000 as tax, calculate your tax refund if your actual tax liability was $ 23,000.

A negative tax refund means that you have to pay an extra $ 3,000 to settle your tax debt.