MAGI is short for modified adjusted gross income.

It can be defined as your household’s adjusted gross income with any tax-exempt interest income and certain deductions added back.

MAGI is an important calculation when determining whether or not you qualify for a number of tax credits, benefits, and exclusions making it ever important for tax purposes.

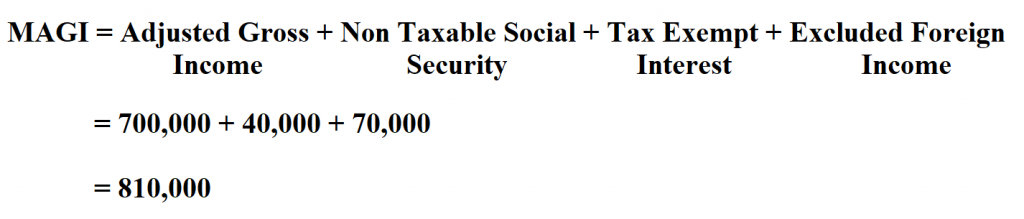

Formula to calculate MAGI.

Example:

Suppose a firm’s AGI is $700,000, if the non taxable social security is $40,000, calculate the MAGI if the tax exempt interest was $ 70,000.

In this instance, there is the absence of excluded foreign income, thus we will use what has been given.

Therefore, the firm’s MAGI is $ 810,000.