Gross income measures total income and revenue from all sources. Individuals determine gross income based on total wages or salary before any tax deductions whereas, for a business it is calculated the revenue earned from the sale of goods and services minus the cost of goods.

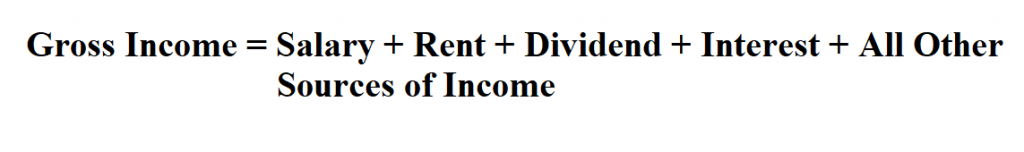

Formula to calculate gross income for an individual.

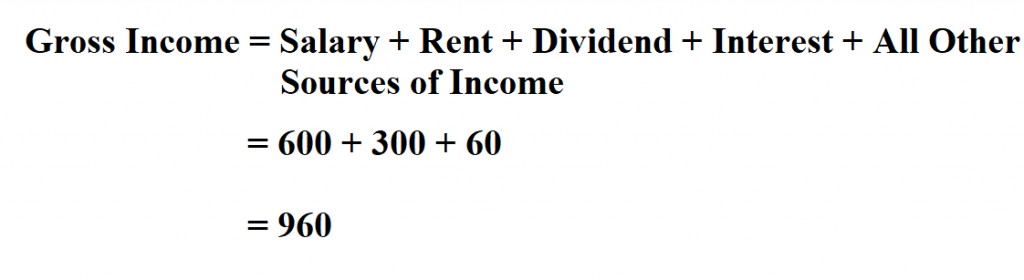

Example 1:

Walter O’Brien is an employee in company. He is paid a salary of $ 600 every month, he pays rent worth $ 300 every month and he has an investment where he gets $ 60 as dividends every month. He has no other source of income. Determine his gross income.

Thus, Walter’s gross income is $ 960.

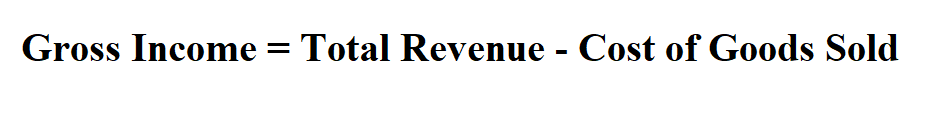

Formula to calculate gross income for a business.

Example 2:

Company X made a total revenue of $ 500,000 in a certain financial period. The cost of goods sold was $ 200,000. Determine the company’s gross income.

Therefore, the company’s gross income is $ 300,000.