Depreciation is defined as a reduction in the value of an asset that occurs over time as the asset gets older or as wear and tear occurs.

Calculating depreciation is important because it represents the use of assets in each accounting period.

Formula to calculate depreciation.

Cost of an asset is the initial cost of purchasing the asset.

Salvage value is the estimated resale value of an asset at the end of its useful life .

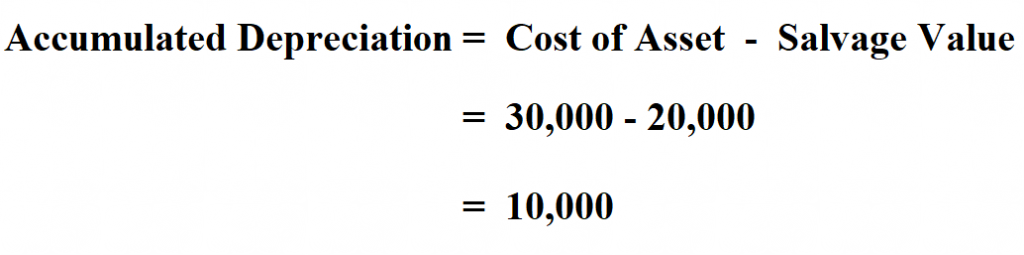

Example:

Chris bought his car in 2018 at a cost of $ 30,000. He sold it at the beginning of 2020 at a cost of $ 20,000. Calculate the accumulated depreciation expense of the car.

Therefore the depreciation expense of the car is $10,000.